Do You Have More or Less Disposable Income Than the Average Person in Your State? Use This Calculator to Find Out. Where you live can make or break the bank when it comes to monthly spending money.

By Amanda Breen Edited by Jessica Thomas

Key Takeaways

- Nearly half of Americans say cost of living is their biggest barrier to saving, according to a recent survey.

- Online lender CashNetUSA calculated how much disposable income Americans have each year nationwide.

One-third of Americans (33%) say they couldn't cover bills for even one month if they lost their income, and 47% cite the cost of living as their biggest obstacle to saving, according to a recent survey from Yahoo Finance and Marist Poll.

Every state's living wage is at least $82,000 a year, and in 26 states, a family of four must earn at least $100,000 annually to be considered "financially secure" — or $150,000 if they're in Hawaii, Massachusetts, California and New York, per GOBankingRates data.

Naturally, many people feel they don't have much money left over once they contribute to essential costs and savings accounts.

A new study from online lender CashNetUSA explores exactly how much disposable income Americans have in every state annually — and comes with a calculator for you to determine your own and see how it compares.

Related: Young People Earning More Than $200,000 a Year Are Fleeing 1 U.S. State — and Flocking to 2 Others

Use the 50/30/20 budget calculator here to figure out how much monthly after-tax income you can spend on "wants" versus "needs" and "savings":

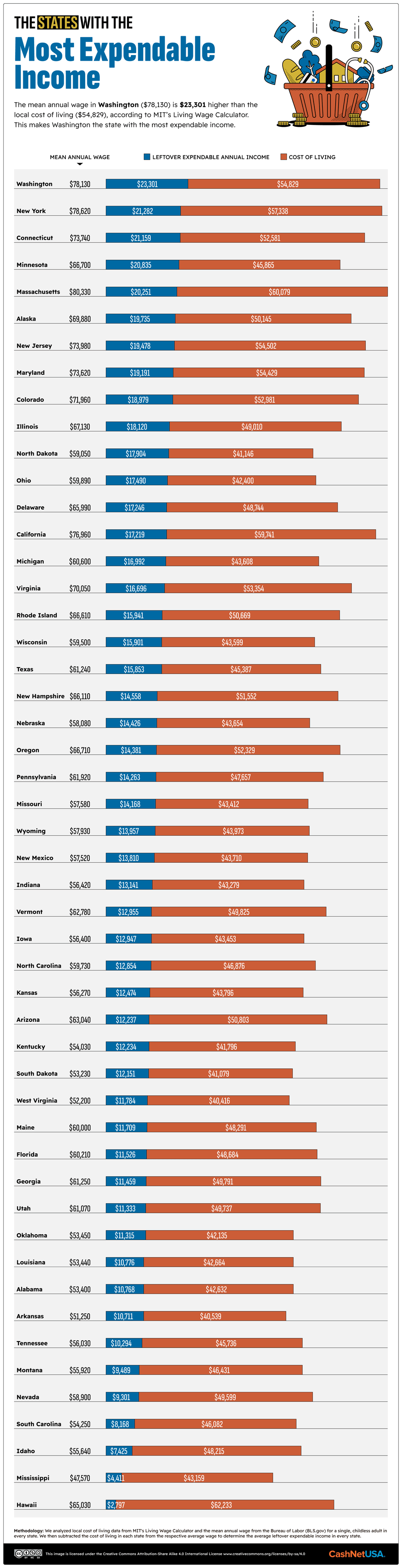

CashNetUSA's research, which examined cost of living data from MIT's Living Wage Calculator and average wages by metros from the Bureau of Labor Statistics, found that single people in Washington have, on average, more disposable income than those in any other state: $23,301.

Residents of New York, Connecticut, Minnesota and Massachusetts rounded out the top five states where people have the most disposable income each year, with averages ranging from $20,251 to $21,282, per the data. No other states in the ranking had disposable incomes that reached or exceeded $20,000.

Americans in Hawaii have the least amount of disposable income at just $2,797, and those in Mississippi, Idaho, South Carolina, Nevada and Montana also landed in the bottom spots, with averages running from $4,411 to $9,489, according to the study. All other states saw disposable incomes hit or surpass $10,000.

Check out CashNetUSA's full disposable income breakdown by state below:

Image Credit: Courtesy of CashNetUSA

Image Credit: Courtesy of CashNetUSA